+86 18968869621

+86 18968869621 Analysis of T8 Bracket Lamp Import-Export Trends in H1 2025

The global T8 bracket lamp market in H1 2025 saw dynamic shifts driven by trade policies, technological upgrades, and regional demand changes.

Key trends included tariff-induced market realignment. The U.S. raised tariffs on Chinese lighting products by 10% in February 2025, pushing the average rate for T8 bracket lamps to 35.6%. This caused a 5% YoY drop in China’s direct exports to North America in Q1. To counteract this, Chinese manufacturers expanded production in ASEAN—Vietnam’s T8 exports surged 40% in H1, leveraging lower tariffs and proximity to EU markets.

Technological compliance shaped product flows. The EU’s ErP 2025 energy efficiency standards (mandating ≥85 lm/W for non-directional LEDs) boosted demand for high-efficiency T8 models. Smart variants with IoT dimming and UV-C disinfection, certified to ErP and TUV, dominated Europe’s premium segments. Meanwhile, cost-effective Chinese models ($1.99–$2.89 for 1.2m tubes) targeted price-sensitive markets like Southeast Asia and Africa.

Emerging economies drove growth. African imports of Chinese T8 lamps rose 17% YoY, led by Nigeria and South Africa’s infrastructure projects. The Middle East saw LED penetration hit 26%, with Saudi Arabia and the UAE prioritizing energy-efficient retrofits.

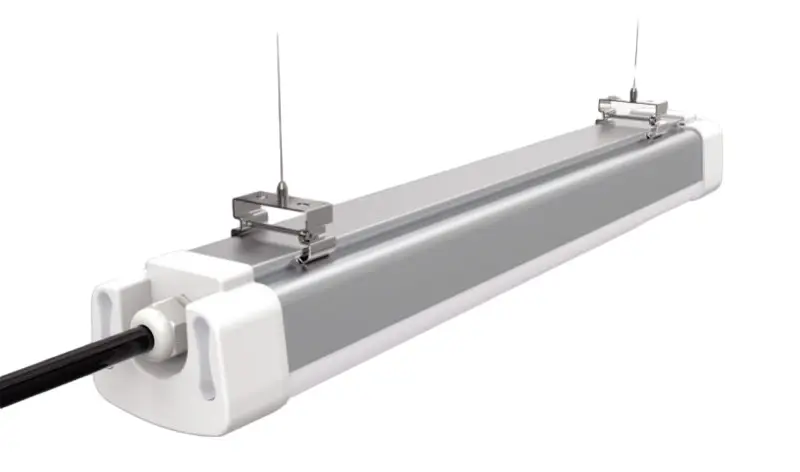

Supply chains faced pressures: aluminum substrate costs climbed 13.4% in H1. However, Chinese manufacturers offset this via automation (18% lower production costs in smart factories) and vertical integration. Guangdong-based suppliers, for instance, offered IP65-rated tri-proof T8 lamps at $5.2–$6.4/1.2m, catering to industrial needs in Europe and the Middle East.

Challenges included global economic slowdowns and oversupply in mature markets. Yet, long-term prospects remained positive, fueled by urbanization in India/Southeast Asia (Vietnam’s T8 demand rose 22% in H1) and China’s dual carbon policy, which mandates energy-efficient retrofits.

In summary, H1 2025 was marked by tariff-driven diversification, tech differentiation, and emerging market expansion. China retained 38% of global exports, while ASEAN hubs like Vietnam emerged as key players. Compliance with regional standards and smart/UV-C innovation will drive future growth.